How it will help you?

The GUS Integration module solves the problem of manual data entry and verification. Just enter the VAT ID – company details are automatically fetched from the GUS database.

It also checks VAT status and retrieves bank accounts from the Ministry of Finance whitelist, ensuring compliance and secure transactions.

All within Odoo – saving time and reducing errors.

Features Documentation Configuration Support FAQ

All features

Automatic completion of company details based on NIP (VAT ID)

Verification of VAT status (active, exempt, or not registered)

Retrieval and comparison of bank account numbers with the Ministry of Finance whitelist

Batch processing for VAT verification of multiple partners

Where it works?

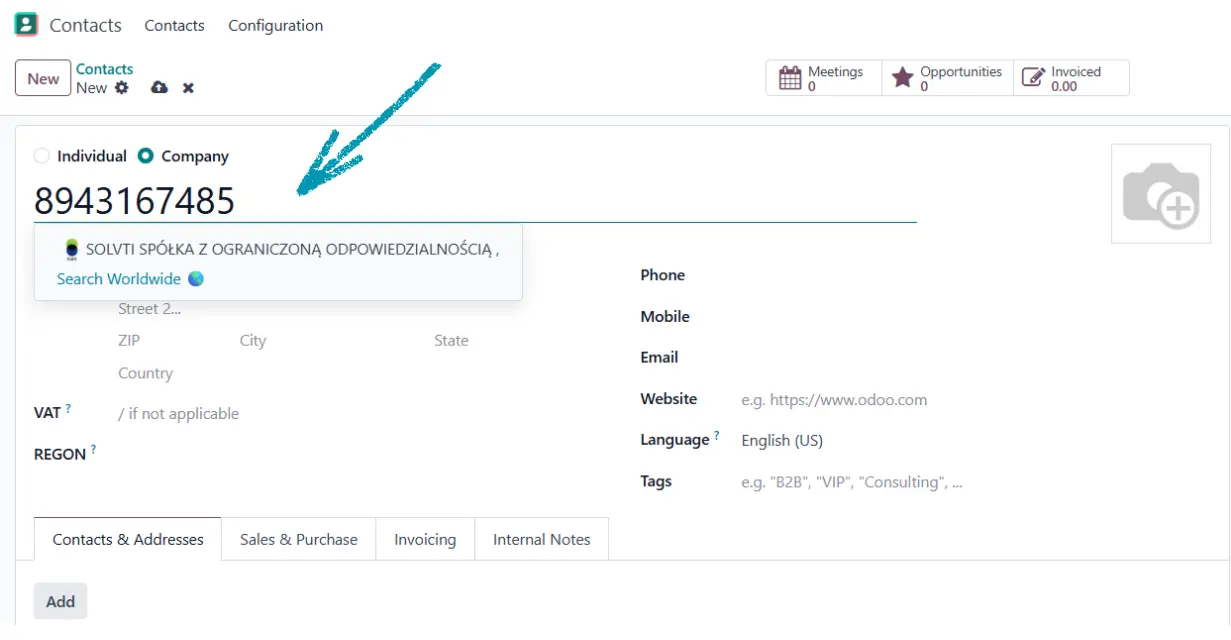

Contacts

Enter the company’s NIP in the main, name field.

The system will automatically search the GUS database and suggest matching results.

Contact details are automatically filled in based on GUS data (e.g. company name, address, REGON).

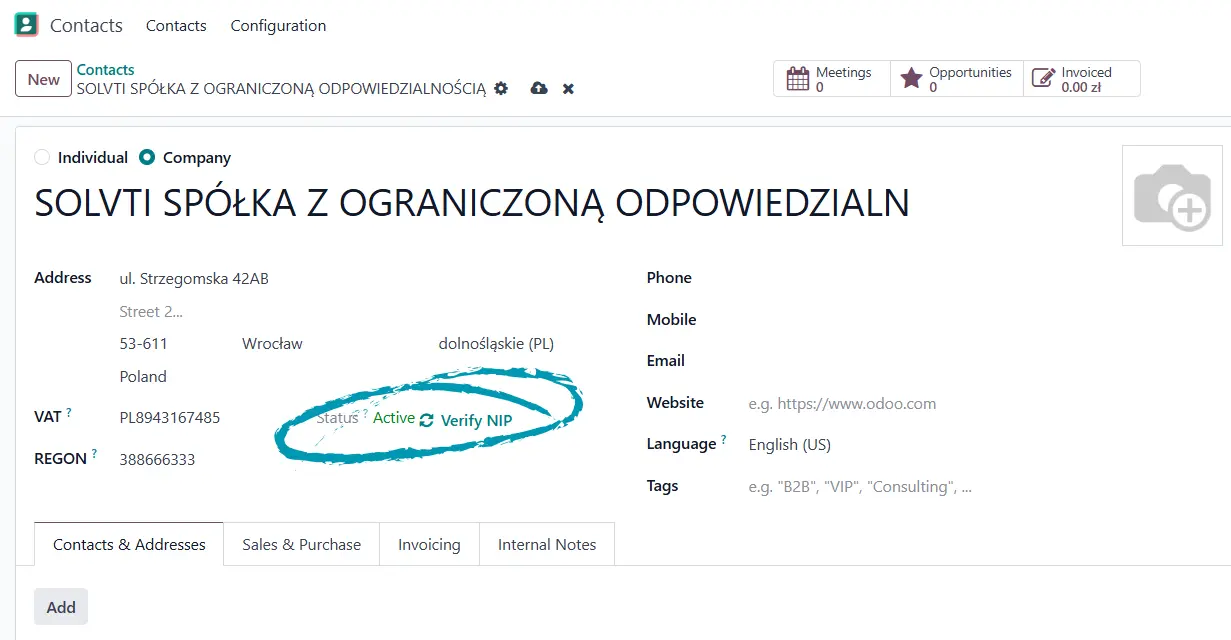

The VAT Status section appears, where you can verify the current VAT registration via the Ministry of Finance.

By clicking “Verify NIP”, the system will fetch and display the up-to-date status (e.g. “Active”).

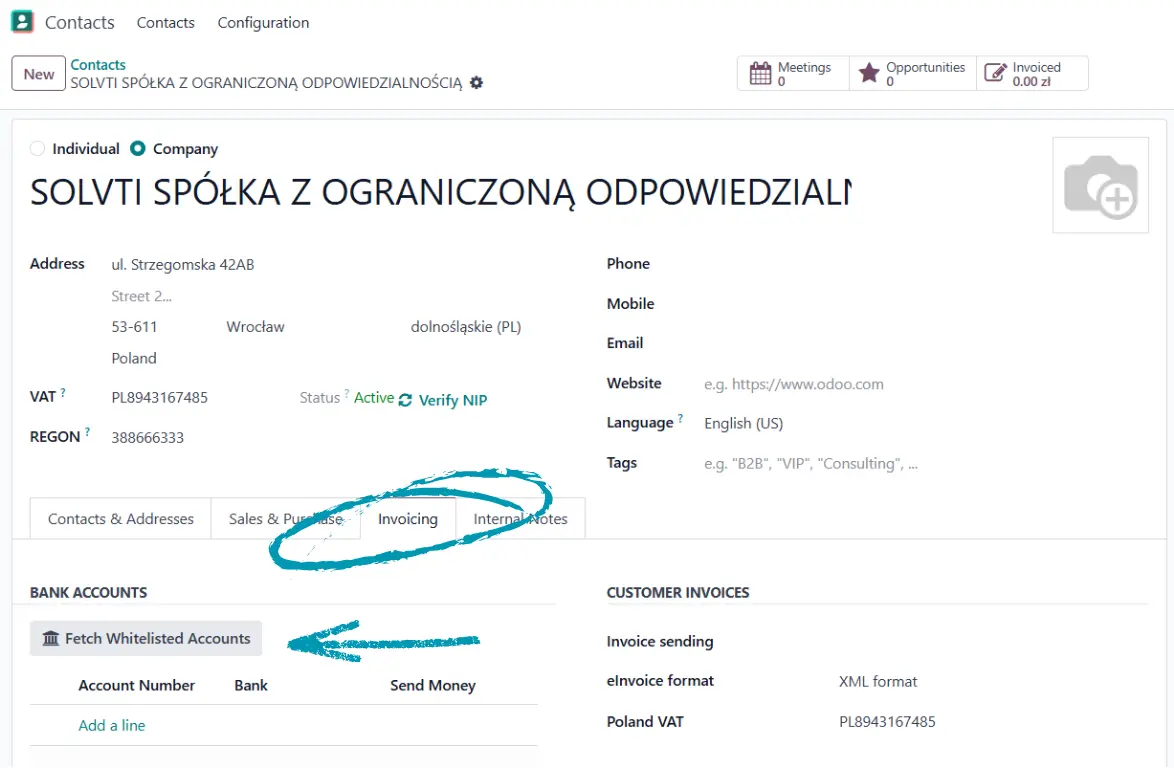

Go to the Invoicing tab in the partner form.

Click the Fetch Whitelisted Accounts button in the “Bank Accounts” section.

Verified bank accounts registered with the partner's VAT ID will be fetched from the Ministry of Finance system.

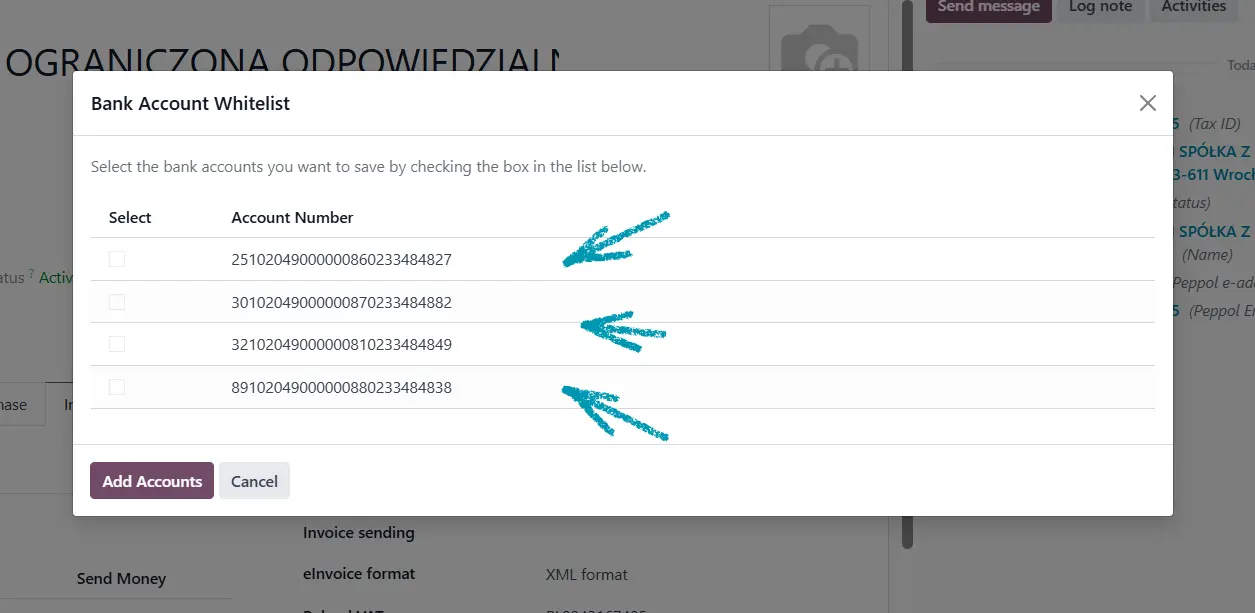

Select the account(s) you want to add and confirm.

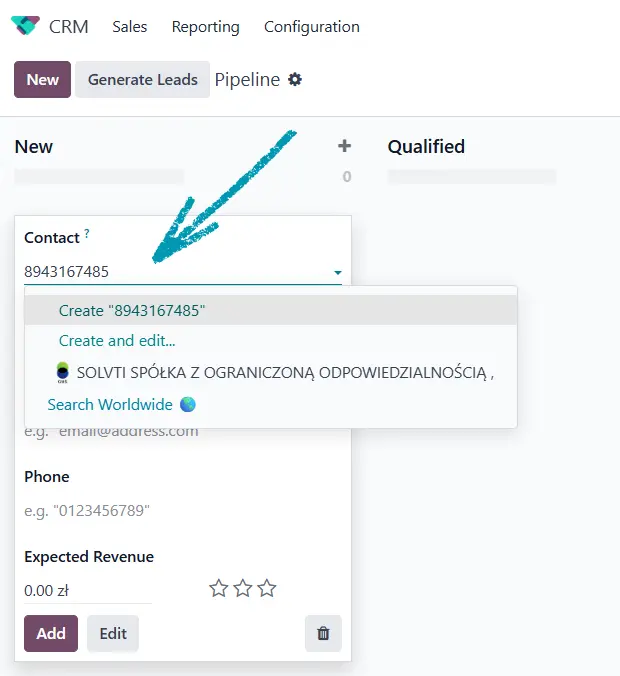

CRM

In the CRM module, enter the customer's Tax ID number in the Contact field on the opportunity form to trigger the automatic GUS search feature.

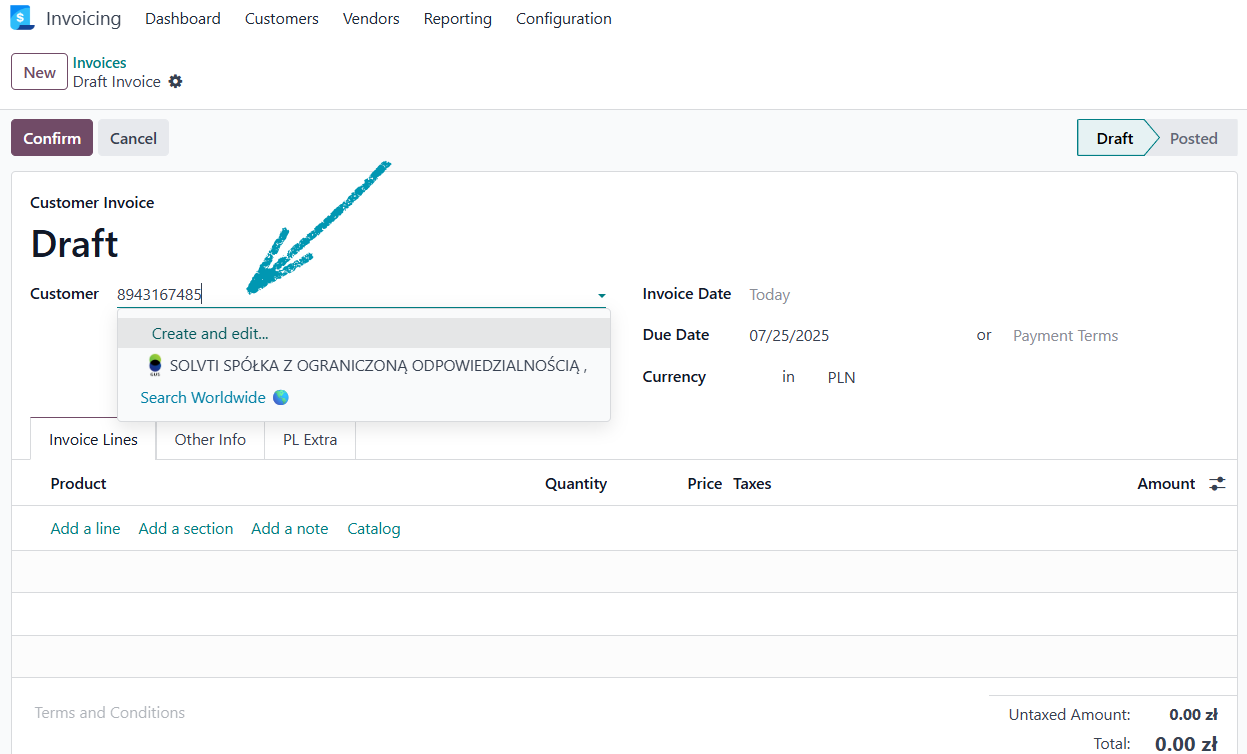

Accounting

In the Accounting module, enter the customer's NIP in the Customer field on the invoice form to trigger the automatic GUS search feature.

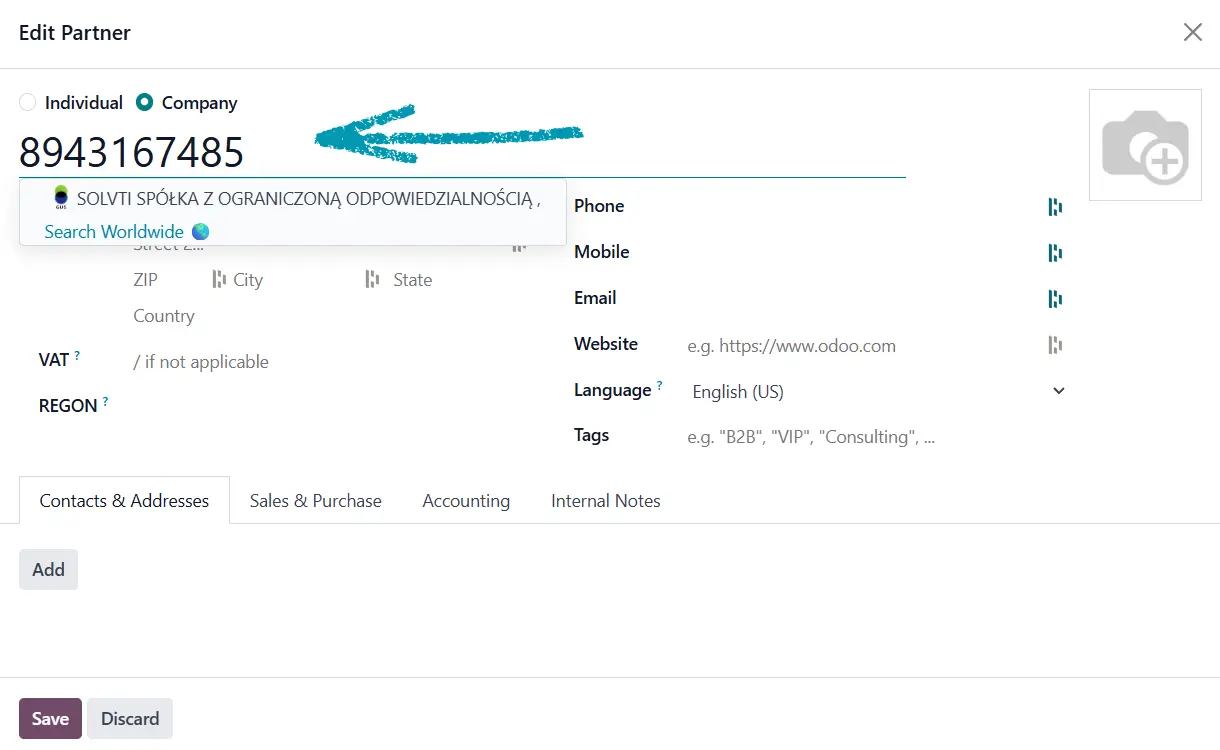

POS*

In the POS module, enter the customer’s NIP directly in the customer form. Don't forget to click "Company" type of contact. The system will automatically fetch company details from GUS, making the checkout faster and more reliable.

*Currently, the POS module is not compatible with Odoo version 17.

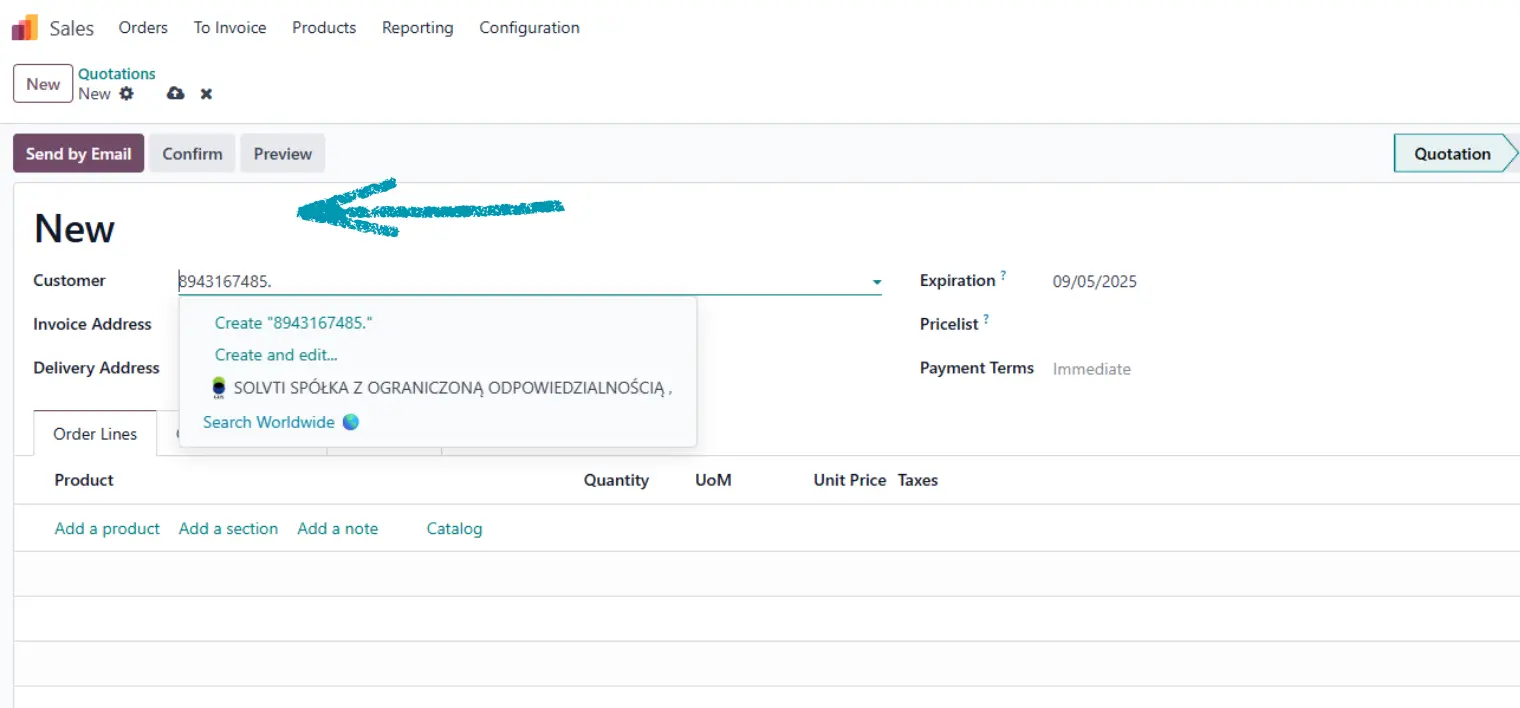

Sales

In the Sales module, enter the customer’s NIP directly in the customer field.

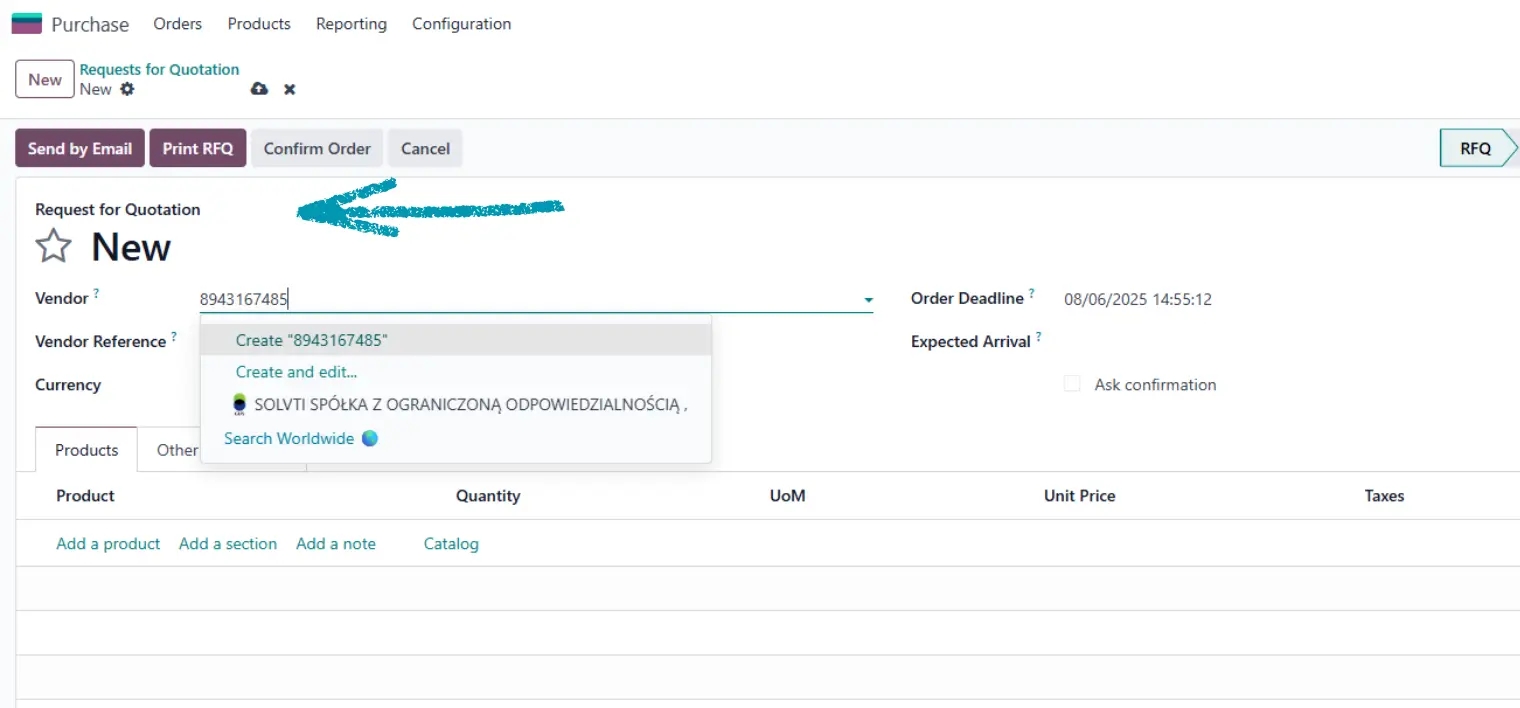

Purchase

To use this module in purchase app, enter the customer’s NIP directly in the customer field. Find your vendor information faster.

Downloaded the Module?

Here’s What to Do Next

To start using the GUS integration, you’ll need to obtain a User Key. The process is simple – just click and send a pre-filled email.

Fill in the required information directly in the email template, and the authorities will take care of the rest.

You can also prepare the email manually by entering the required information yourself.

To do so, visit GUS website, where you’ll find all necessary details

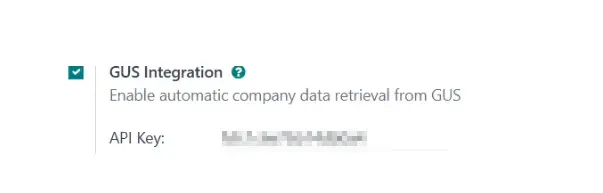

Configuration

Install the module in your Odoo instance

Go to Settings in your Odoo instance.

Enable the option by clicking the checkbox next to GUS Integration.

Enter your GUS API key (obtained from the official GUS service)

Support

If you have any questions or encounter issues with the GUS module, please contact us via email at support@solvti.com.

Our team will be happy to assist you!

FAQ

Yes, queries to the Ministry of Finance database are made online, and VAT status is updated immediately.

Yes, the module offers a batch verification function, which can be triggered manually from the partner list view.

In that case, the system will not suggest any data to fill in, and the user will be informed that no results were found.

Yes, the data can be manually edited after import – the module does not lock the fields.

You can obtain the API key by registering on the official website of the Polish Central Statistical Office (GUS): https://api.stat.gov.pl/Home/RegonApi

After registration, submit a request for access to the BIR (REGON Internet Database) service. Once approved, you will receive your individual API access key.