Polish Invoicing + KSeF

Polish invoicing + Odoo KSeF integration

| Odoo Version: 18.0 |

The Poland Invoicing module combines Odoo–KSeF integration with an invoice view adapted to the legal requirements in force in Poland.

The solution enables:

- sending and receiving invoices via KSeF directly from Odoo,

- issuing invoices compliant with Polish regulations (VAT, NIP, rates, required markings),

- working with a clear, local invoice view, understandable for accounting teams and authorities,

- reducing manual corrections and the risk of formal errors.

The module is intended for companies operating in Poland that want to use Odoo while meeting local accounting requirements and integrating with KSeF.

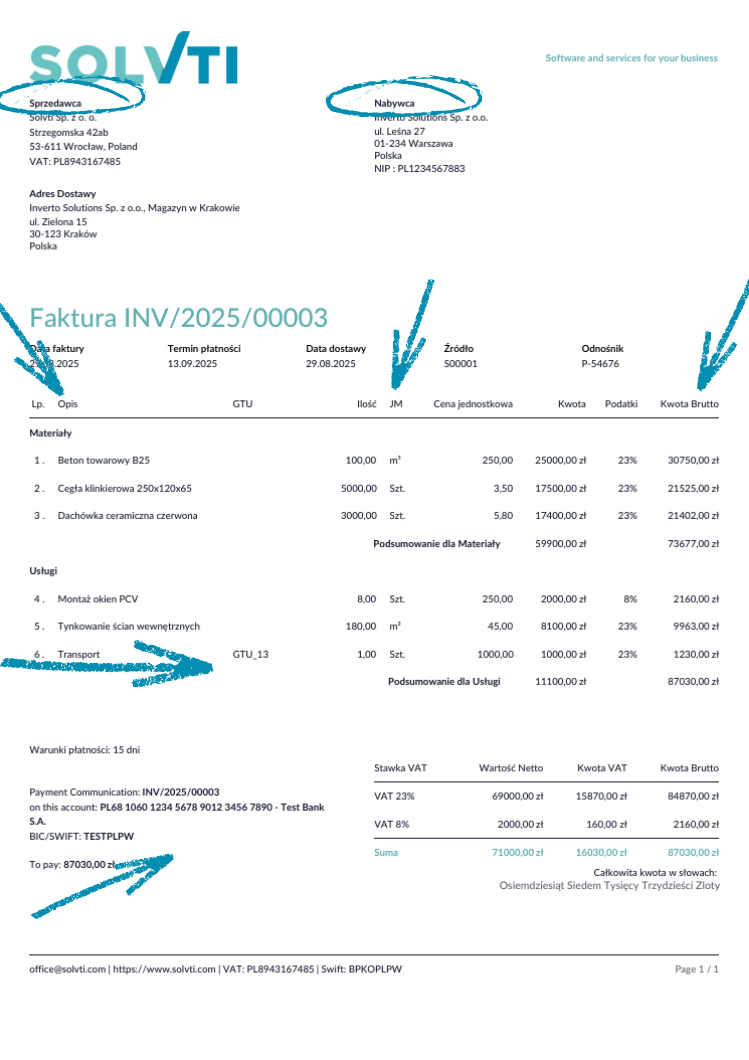

Standard invoice

Benefits

-

Clear headers

With a clear distinction between seller and buyer, invoices are easier to read and leave no room for mistakes. Your clients quickly find the data they need, and your accounting team avoids confusion.

-

Line item numbering

Each line on the invoice has its own number. This simple feature makes communication smoother – it’s easier to reference a specific item during complaints, orders, or customer conversations.

-

Units of measure

Invoices include the mandatory element required by Polish law. You can be confident your documents are fully compliant and won’t be questioned during audits.

-

GTU code

Products and services are automatically labeled with the correct GTU codes according to Polish tax regulations. No need for manual work – you save time and avoid costly errors.

-

Gross amount

Each item comes with an additional column showing the gross value – the actual amount your customer will pay. This makes invoices clearer and easier for clients to understand.

-

Automatic bank account matching to invoice currency

The system automatically selects the right bank account depending on the invoice currency. This eliminates the risk of customers paying to the wrong account and speeds up settlements.

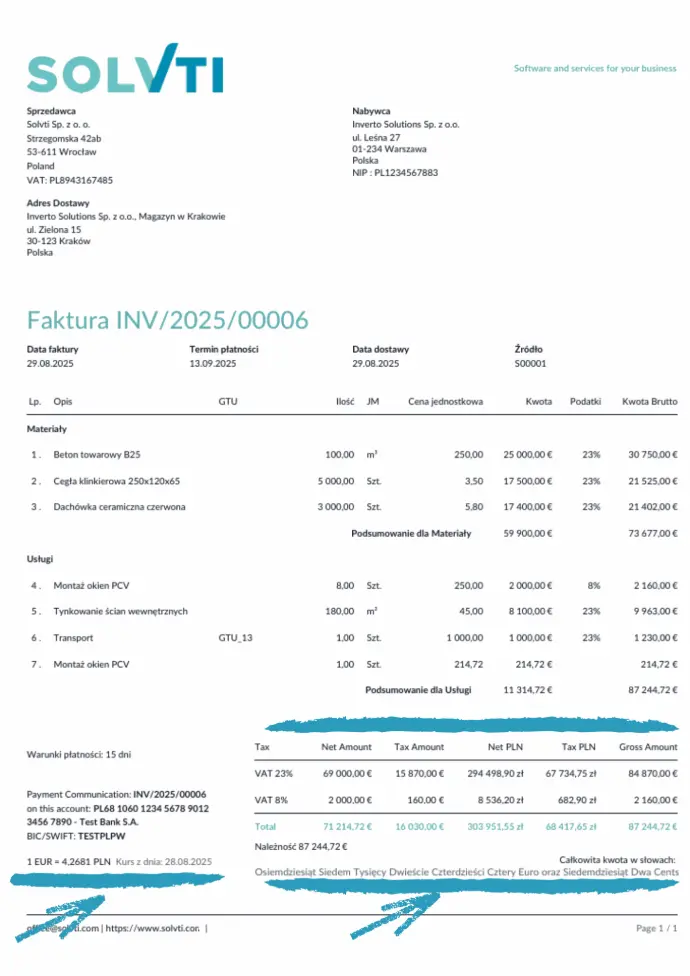

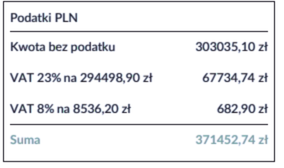

Multi currency invoice

Benefits

- Tax summary table

For foreign currency invoices, the module adds a tax summary table in PLN. This ensures that the net amounts and VAT are immediately visible in Polish złoty – exactly as required by Polish accounting standards.

-

Visible exchange rate date

The invoice clearly shows the date when the exchange rate was retrieved from NBP, making verification easier and ensuring compliance with accounting requirements.

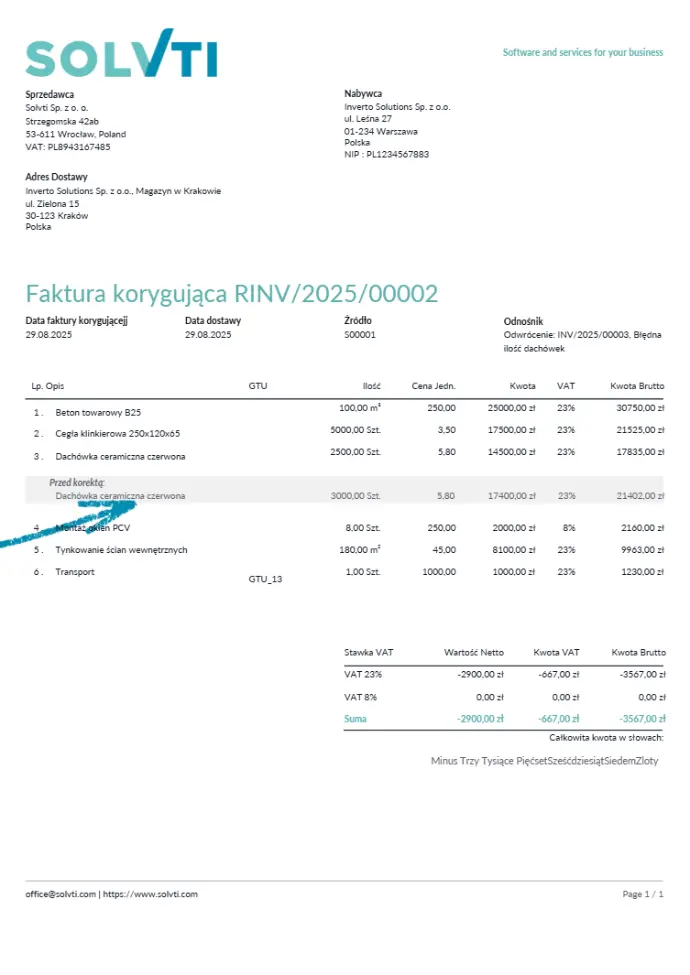

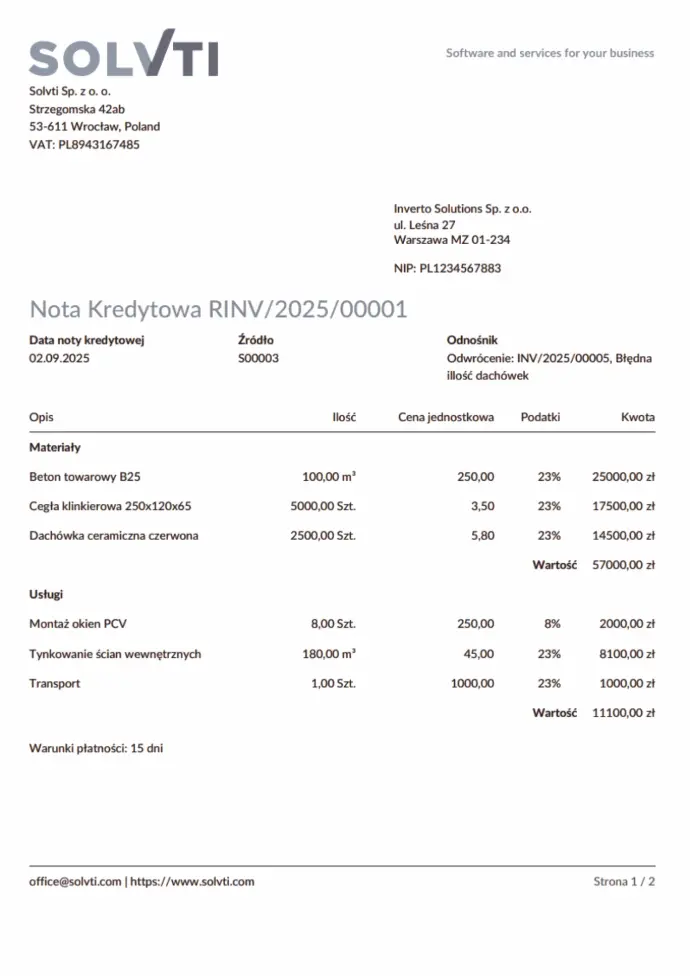

Credit notes

Benefits

-

Clear highlighting of corrected lines

Each item that has been modified in the credit note or correction invoice is clearly marked with a dedicated stripe. This makes it immediately visible which parts of the document have been adjusted, without the need to manually compare every line. The result is faster document verification and a reduced risk of errors

Advanced invoice

Benefits

-

Visible order lines on advance invoice

The advance invoice now shows all order lines from the sales order. This makes it clear what the deposit relates to, without opening the sales order. The result is improved readability and easier document verification.

Odoo–KSeF Integration

- automatic sending and receiving of invoices directly in Odoo

- less manual work and a lower risk of formal errors

- consistent accounting data in a single system

- a faster and more structured invoicing process

Watch on YouTube how the Odoo–KSeF integration works in practice and see the full invoicing flow step by step. ⬇️

Support

If you have any questions or encounter issues with Polish Invoice, please contact us via email at support@solvti.com.

Our team will be happy to assist you!

⬇️Want to learn more about Odoo accounting? ⬇️

FAQ

Yes – line numbering works on both advance invoices and credit notes, keeping all documents consistent and easy to review.

Yes – the layout includes all mandatory elements such as GTU codes, units of measure, gross amounts, and PLN tax summary tables.

Yes – you can freely add your own logo or additional fields to match your company’s needs.