Starting February 2026, e-invoicing will become mandatory in Poland. We’ve gathered the essential information to help our clients operating in Poland — and all visitors to the Solvti blog — get ready for KSeF. Whenever I read or hear about KSeF, I get the feeling not many people have a positive view of it :) Personally, I’m glad that Poland is moving toward digitalization and becoming one of the first countries in Europe (after Italy) to implement e-invoicing on such a scale. Globally, e-invoicing is a growing trend — several countries have already adopted it in some form, and many more have announced plans to do so.

The introduction of KSeF is part of a broader Digital Transformation Strategy for Poland. KSeF has technically been live since 2022, but only on a voluntary basis. The official go-live date for mandatory use has been postponed a few times, but as of now, it looks like the current timeline is final (you’ll find it further down in this article).

What is KSeF and how does it work?

The National e-Invoicing System (in Polish: Krajowy System e-Faktur, short: KSeF) is a government IT platform that enables the issuance and receipt of structured invoices (in XML format).

In practice, instead of sending invoices directly to clients, we’ll send them through a centralized state platform, which assigns each invoice a unique identifier and confirms its authenticity. Sending an invoice to KSeF is considered equivalent to delivering it to the recipient. You can still send the invoice via email (which will probably be a common practice during the transition period), but technically, delivering it to KSeF is enough.

Each invoice will receive a unique number consisting of the following elements (sorry, for lack of translation):

Source: https://ksef.podatki.gov.pl/media/p4mpdzx1/opis-elementow-numeru_ksef.pdf

So in practice, an e-Invoice means:

- An XML file based on the FA(3) structure

- A KSeF number

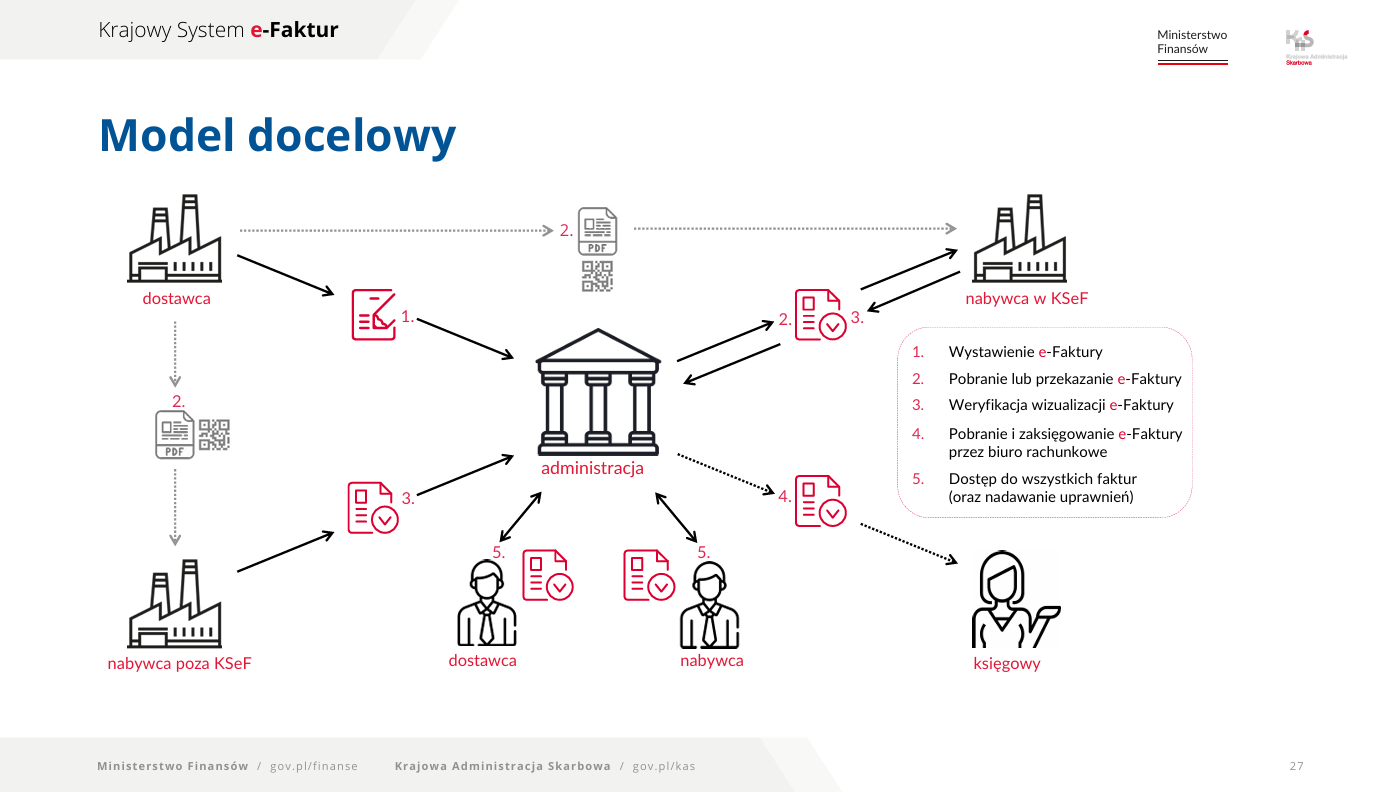

Here’s what the KSeF model looks like (sorry again, that we didn't translate it from Polish):

Source: https://ksef.podatki.gov.pl/media/3qjni3jo/ksef_prezentacja_grudzien_2023_ver_2_2.pdf

When does KSeF go live?

The current rollout timeline is as follows:

-

February 1, 2026 – mandatory for large companies (annual turnover above PLN 200M)

-

April 1, 2026 – mandatory for all other businesses

-

January 1, 2027 – for “digitally excluded” taxpayers (e.g. invoices under PLN 450, total monthly sales under PLN 10,000)

That means we’ve got less than a year to prepare for KSeF!

Who is affected?

Mandatory use of KSeF will apply to all B2B invoices between Polish VAT-registered entities. It doesn’t matter what type of business you run or what your turnover is — if both the seller and buyer are VAT-registered in Poland, KSeF must be used for invoicing.

Why KSeF? Goals and benefits

The Ministry of Finance has been clear about its main goal: less administrative work and tightening VAT control. Centralizing invoicing is expected to help prevent tax fraud. People in Poland have mixed feelings about this, but given how much money has been lost due to “fake” invoices in recent years, I’m personally glad this system should bring more transparency into invoice flows.

For businesses, KSeF is expected to offer several benefits:

-

Faster VAT refunds (40 days instead of the standard timelines)

- Automation of accounting processes

- Full control over invoice flows

- Document safety through a centralized repository (no more manual archiving!)

Roadmap

The Ministry of Finance has published a detailed implementation timeline (https://www.gov.pl/web/kas/krajowy-system-e-faktur--plan-wdrozenia):

-

June 2025 – release of documentation for KSeF 2.0, updated FA(3) structure, and API documentation

-

September 2025 – API testing begins for integrators and large companies (Solvti will likely start testing KSeF integration in Odoo around this time)

- November 2025 – KSeF 2.0 test version of the Taxpayer App becomes available to all users

- Until end of 2026 – transitional period with no penalties for KSeF-related errors and continued allowance for fiscal receipts.

KSeF vs EU regulations

Important to note: KSeF is a uniquely Polish system. The European Union is working on its own framework — VAT in the Digital Age (ViDA) — which is expected between 2030 and 2035. According to the Ministry of Finance, ViDA won’t significantly affect the functioning of KSeF. But integration discussions are already underway. Let’s hope that in the future we won’t have to send invoices to both KSeF and some new EU ViDA servers :)

Source: https://ksef.podatki.gov.pl/pytania-i-odpowiedzi-ksef/ and https://ikidp.pl/blog/czy-wdrozenie-pakietu-vida-wplynie-na-funkcjonowanie-ksef/

KSeF vs Peppol (PEF)

At the same time, in the public procurement (B2G) sector, Poland uses the PEF platform, which is part of the European Peppol network. Peppol is a standard for exchanging e-invoices compliant with EN 16931 and is natively supported by Odoo. If you invoice public institutions in Poland, using PEF is already mandatory.

After KSeF becomes mandatory, even companies currently using Peppol will eventually need to send their invoices to KSeF.

Source: https://ec.europa.eu/digital-building-blocks/sites/display/DIGITAL/eInvoicing+in+Poland

Summary

KSeF is the inevitable future of invoicing in Poland. While it may seem like another bureaucratic challenge at first glance, it actually brings real opportunities to streamline accounting processes - especially after the transition period. At Solvti, we’ll start using KSeF with Odoo this year so we can test everything firsthand. In the coming months, we’ll be publishing more updates on how KSeF works in Odoo — so feel free to subscribe to our newsletter!

More information:

- Official KSeF website: https://ksef.podatki.gov.pl/ and especially:

- Business.gov.pl portal: https://biznes.gov.pl/pl/portal/004651

- KSeF on the European Commission website: https://ec.europa.eu/digital-building-blocks/sites/display/DIGITAL/eInvoicing+in+Poland